How to Use AI to Prep for Investor Q&A (Prompt Included)

Founders fail pitches in the Q&A, not the slides. Here’s 1 prompt to flip the odds.

Raising your Series A isn’t just about the deck.

It’s about surviving the Q&A that follows.

Raising a Series A has never felt harder. Recent data from Crunchbase shows that for the 2021 seed cohort, only about 36 % of startups ever made it past seed into a Series A or exit.

In more recent article, Carta’s data suggest that just 13 % of companies that raised seed in early 2022 progressed to a Series A.

In short: even among startups that hit seed, most don’t survive the jump, and the Q&A at that stage is often where things fall apart.

So what can you do?

Imagine walking into the room having already defended your numbers, your market story, and your AI angle, against the toughest version of the questions you’ll face. That’s the edge you can create for yourself using AI.

Why Practicing With AI Beats Practicing Alone

Mentors and co-founders are helpful, but they know your story too well. They’ll pull punches. Investors won’t.

What you need is a skeptic who doesn’t care about your feelings. AI, when prompted correctly, can act as that skeptical VC, asking you the hardest questions one by one. Rating your answers, and pointing out where you need to tighten up.

Think of it as a fundraising fire-drill.

Here is the Prompt

Copy-paste this into ChatGPT or Claude and run it.

Pro tip: don’t just type your answers. Use dictation. Speaking out loud forces you to be clear, concise, just like in the real thing.

You are a venture capital investor preparing to evaluate my Series A fundraising pitch.Your role is to simulate a skeptical investor Q&A session to test how well I can defend my business.

Step 1: Collect Context

Before you begin questioning, ask me 3–5 clarifying questions to understand my startup. These should cover:

• What I’m building and for whom

• Current traction stage (users, revenue, etc.)

• Target market and competitive context

• Team and fundraising goal

Step 2: Simulated Q&A

Once you have context, begin acting like a Series A VC.

Ask me questions one by one, waiting for my answer before moving to the next.

Cover the following investor categories (in random order so I don’t just “prepare” for a sequence):

• Market, Problem & Timing

• Product & Differentiation

• Business Model & Unit Economics

• Traction & Growth Metrics

• Go-to-Market Strategy

• Competition & Defensibility

• AI Strategy & Technology

• Team & Execution Capability

• Risks & Challenges

• Vision, Scale & Path to $100M+

• Fundraising Ask & Use of Capital

Step 3: Evaluation of Each Answer

After each of my responses:

Rate the answer on a 3-level scale: Meh / OK / Great

Provide a one-sentence note on how to improve that specific answer.

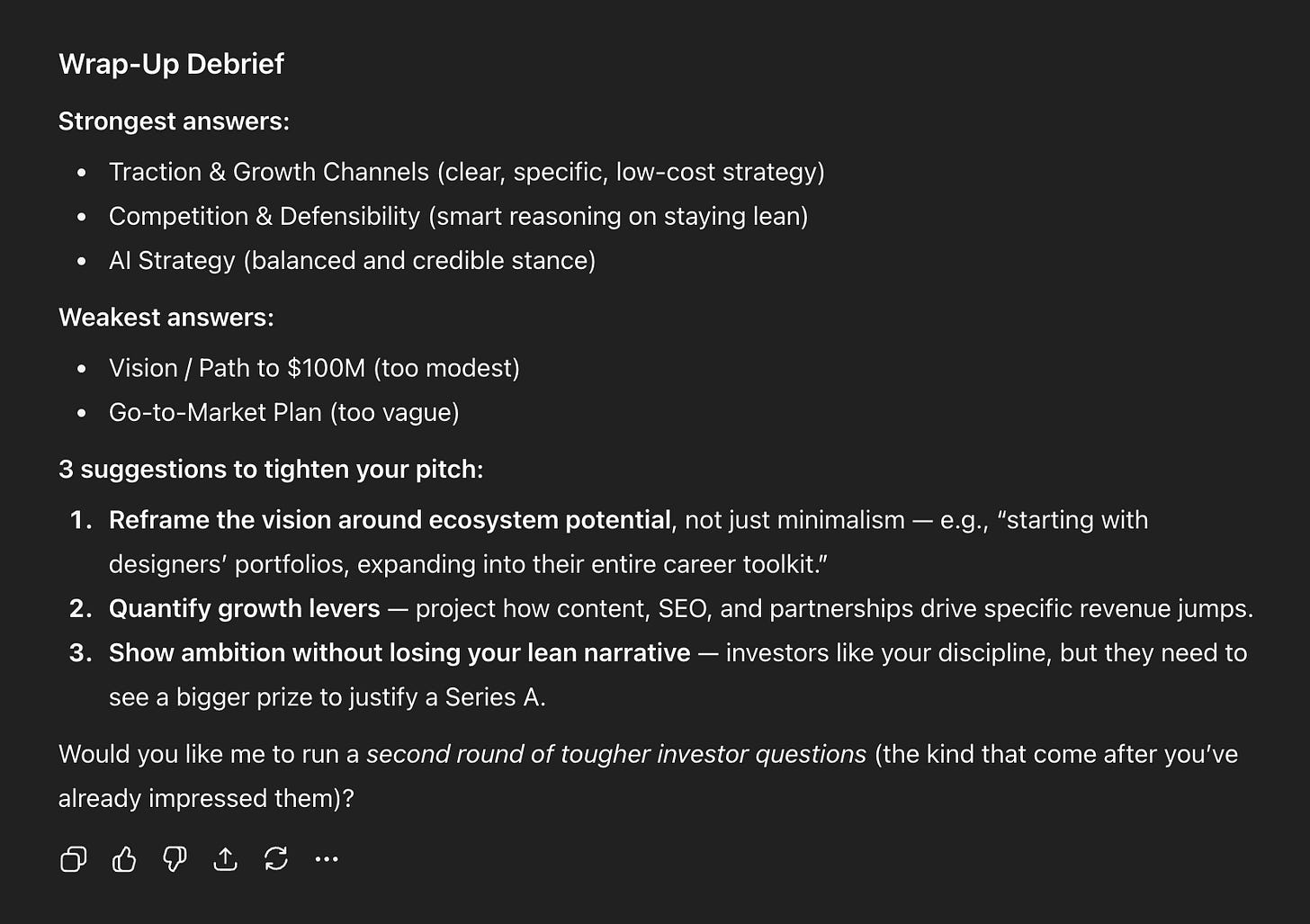

Step 4: Wrap-Up Debrief

After 8–10 questions, stop and provide a final summary:

My strongest answers (where investors would be impressed)

My weakest answers (where investors would likely push back)

2–3 concrete suggestions for how to tighten my pitch before a real investor meeting.What This Looks Like in Practice

I have run this on one of my startup ideas and here is the final debrief.

Took me like 10 - 15 minutes.

Cough 2 weak spots and really got me thinking about the go-to-market plan.

And for the $100M well I happy to lower this number and adjust it to my modest vision.

And for the rest it gave my some confidence that I know my shit when it comes to growth, strategy and AI angle.

Why This Matters

Instead of over-preparing your slides and under-preparing your Q&A, you’ll be doing the opposite:

Stress-testing your story against the hardest questions

Practicing how you sound, not just what you say

Spotting weak points before investors expose them

Run this prompt today. Dictate your answers. Treat it like a rehearsal, because the real thing could cost your fundraising.