How to Use AI to Build a Startup Budget (Prompt Included)

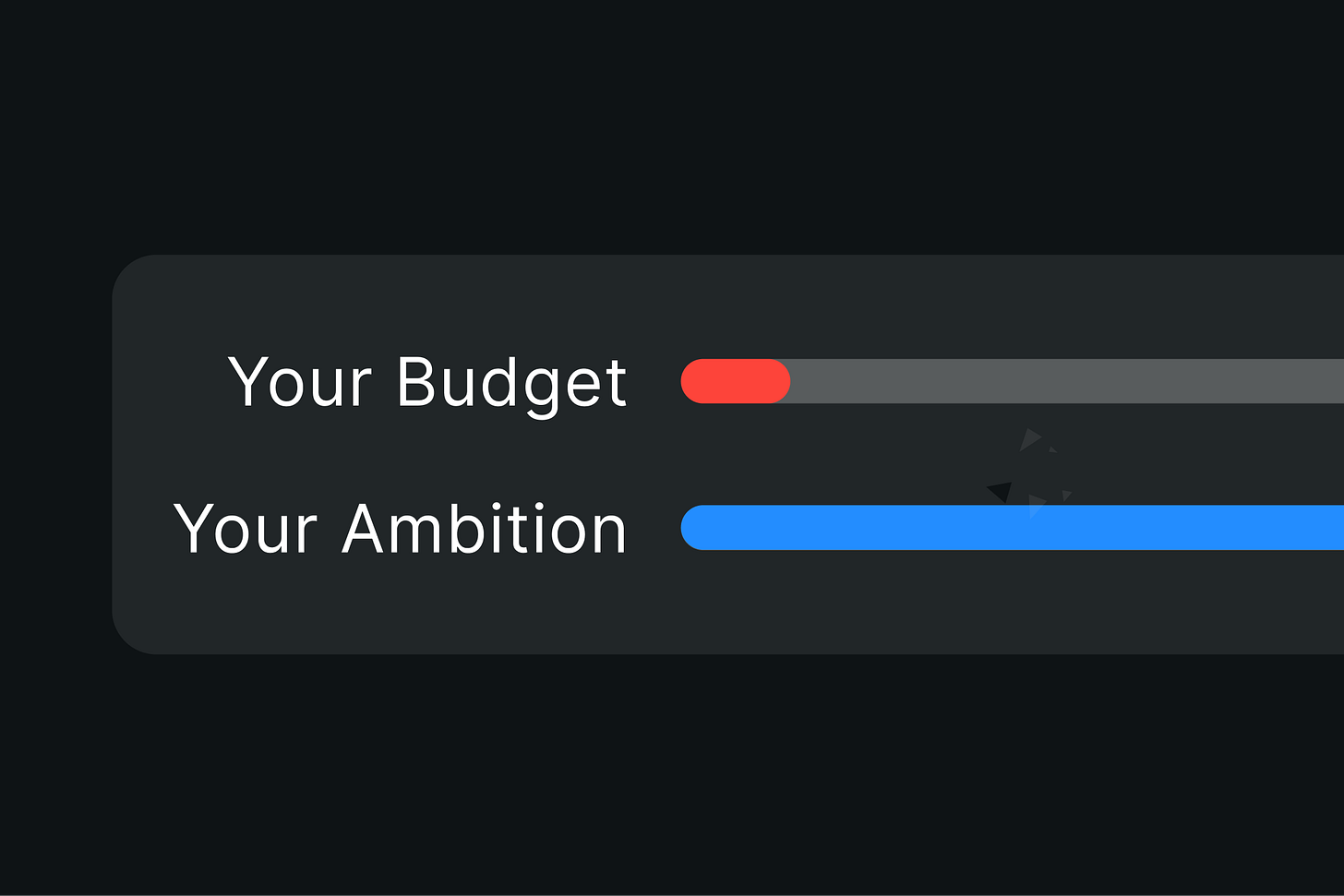

You underestimate how fast money disappears.

You raise funds (or bootstrap).

You set a rough budget and start building.

Three months in, cash flow gets tight.

Unexpected costs pile up.

Suddenly, you're scrambling to stretch every dollar.

The problem?

Traditional budgeting methods don’t fit early-stage startups.

They assume predictable revenue, stable expenses, and clear financial patterns—none of which exist when you’re just getting started.

You need a budget that adapts as you learn.

One that prioritizes survival, growth, and speed.

Not just financial discipline.

A Smarter Way to Budget

Instead of making a static budget, use an adaptive AI-driven approach that:

Prioritizes key expenses that drive growth

Flags unnecessary costs before they spiral

Adjusts in real time based on your cash runway

Think of it as a financial co-pilot that helps you plan smartly without getting lost in spreadsheets.

The AI-Driven Startup Budget Framework

Define Your Baseline

What’s your total capital? (Savings, investment, revenue)

What’s your planned runway? (6, 12, 18 months?)

Identify Your Essential Costs

Core expenses (team, tools, hosting, marketing)

One-time vs. recurring costs

Allocate Based on Growth Drivers

Prioritize expenses that directly impact user acquisition, retention, or revenue

Use AI to model scenarios (e.g., “What if we cut tool X?” or “What if we increase ad spend?”)

Set Dynamic Cash Flow Monitoring

Use AI tools (like ChatGPT or Claude) to track actual spending vs. projections

Get automated alerts when burn rate exceeds safe limits

Run 'Survival Scenarios'

What happens if revenue stalls for 3-6 months?

How can you reduce costs without killing growth?

The Startup Budgeting AI Prompt

Copy-paste this into ChatGPT or Claude to get a startup-specific budget plan:

I’m building [your startup] and need a realistic budget for the next [X] months.

My available capital is [$X], and my expected revenue is [$X/month].

Here’s what I know:

- Core expenses: [list your fixed costs like team, software, hosting]

- Growth expenses: [list variable costs like marketing, partnerships]

- One-time costs: [list any big upfront investments]

- Runway goal: [e.g., “I need to last 12 months before raising again”]

Help me:

1. Identify critical vs. non-essential expenses

2. Suggest a burn rate strategy to keep my runway safe

3. Recommend adjustments based on realistic scenarios

4. Spot any financial risks I might be missing

Run this prompt, tweak the numbers, and refine based on the AI’s suggestions.

It’s like having a CFO without a full-time salary.

Why This Works

Focuses on what matters (growth + survival, not just numbers)

Quick to update (adjust as reality changes)

Helps catch blind spots (AI sees patterns humans miss)

Try it out and see if your budget is truly startup-proof.

What’s the biggest budgeting mistake you’ve made in your startup?

Hit share in the comments—I might include it in the next issue.

PS: Was that useful? Leave me a ♡ so I know I’m on the right track.

What founder challenge should I tackle next?